Why Bitcoin not something else

Why Bitcoin not something else

-

August 8, 2021

- Posted by: Farhad

I often get asked about “which crypto” is a good one to invest in. Of course, my answer is always bitcoin. Period.

In this article I’d like to lay out the rationale from three angles:

- Economic

- Philosophic

- Moralistic

It’s not close-mindedness, but an arrival to a point of truth. We have one chance to take down the Goliath. Wasting time on distractions doesn’t help you, me or anybody else for that matter.

Let’s begin.

THE ECONOMIC RATIONALE

On a long enough time frame, every single government issued money, cryptocurrency, stock, bond, property or asset of any kind will trend toward zero when priced in the hardest, most liquid, sound money that’s ever emerged.

And it won’t happen by the fiat decree of some organization or institution. It will happen by pure economic natural selection, or what I like to call “Economic Darwinism.”

MONEY IS THE CORNERSTONE OF ALL CIVILIZATION.

It’s how we store and exchange the product of our labor, and subjectively measure our individual inputs into society. It’s the fabric that binds us. It enables us to cooperate across time and space, both at scale and in greater degrees of complexity. Money has and always will exist. The only thing that changes and evolved over time is what we use as money.

We’ve now arrived at a point where money can be represented perfectly.

MONEY IS THE BIGGEST MARKET.

There is no larger segment of the global market. Not energy, not food, not transport, not government, entertainment, healthcare or anything else.

Money is larger than all of them, because it represents all of them, combined.

Today, because we have broken money, many of us hold different assets with different attributes in order to store value and protect our wealth. But, with the emergence of a perfect money, that is immune to confiscation, inflation and corruption, that can be taken anywhere, anytime and sent or received by anyone for any reason, without requiring permission, we will see the monetary premium being stored in these other goods or assets diminish.

As Bitcoin transforms into a unit of account, through which all other goods, services and anything of value is measured, the purchasing power of a full bitcoin will trend toward heights that few could today fathom.

Knut Svanholm dubbed it most accurately:

Everything there is, divided by 21 million.

ECONOMIC NECESSITY

As more people realize that the product of their labor (i.e., their wealth, their savings and their money) is constantly being eroded, they are going to seek to store it in something that cannot be diluted. Bitcoin is the best possible option. It is accessible all around the world, and can be stored as pure, unadulterated, unconfiscatable information.

Whether you’re rich or poor, left or right, employer or employee, storing your wealth somewhere safe is only getting more important.

In the same way you would not work all week only to accept salt from your employer as payment, as more time passes, less and less people are going to accept inferior government issued, or random-developer issued fiat money as payment for any of their goods and services.

In fact, future generations will look back on us today and wonder how, in the name of all that is sane, did we believe that measuring our wealth in a currency or money issued by some overlord, that devalued over time, ever made sense. It’s antithetical to the notion of progress and freedom.

BITCOIN IS PERFECT MONEY.

Bitcoin is superior to all other forms of money because it perfectly embodies every attribute of the meta-idea that is money. It’s open source; always on; not just fixed, but known in supply; verifiable by anyone; voluntary; permissionless; digital and directly rooted in the second law of thermodynamics. As a result, it performs the functions of money flawlessly.

- It’s the perfect store of value:

I know exactly how much I have in relationship to the whole, and I know that it cannot be diluted, altered or co opted. - It’s the perfect medium of exchange:

I can send what I want, to whom I want, whenever I want and there is no power in the universe that can stop me from doing so. - It’s the perfect unit of account:

I can measure all other goods and services in sats and as the purchasing power grows, it’s pure digital nature means we can continue to sub-divide the units to measure smaller and more fractional goods and services, forever.

The best money always wins.

There is no outcome where Bitcoin loses, because the best money always wins by the sheer force of natural selection and survival.

Gold and silver emerged victorious over millennia of monetary war. Gold-backed promissory notes then crushed silver. Gold was then defeated by its leviathan: nation-state fiat.

Now, bitcoin emerges, as the alpha-omega of money, and it will strip all assets of their monetary premium.

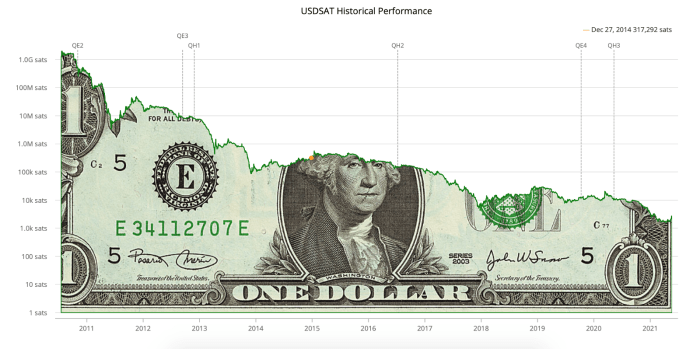

It’s been happening for 12 years straight already. Go ahead and measure any asset in the world against bitcoin, and you’ll find that it’s down anywhere between 90% to 99% since its inception, when priced in bitcoin.

And this is only the beginning. Bitcoin hasn’t started sucking the air out of the larger asset classes yet.

Source:

The longer the chart, the worse it looks for the USD.

This is a log chart, so the fall doesn’t look as drastic, but you can see USD has devalued many order of magnitude against bitcoin

See the full chart and data here:

2,879 sats (this website is a live view of the price of the USD in satoshis).

CONVERGENT NETWORK EFFECTS

Money, like language, has a convergent network effect, meaning that it’s most useful when on a common standard.

In fact, transport, transmission and communication media all converge around particular standards in order to optimize for efficiency.

You see it everywhere:

- The protocol stack that represents the internet, ie; TCP/IP, HTTP

- The gauge on train tracks (which was the same gauge on Roman chariots)

- Shipping container sizes

- Vowels and consonants in any particular language

Money is the grandest, oldest language and energy transmission medium of all. It’s how we measure, store and transact human action and it has been with us since the beginning of time.

As a result, money is a winner-take-all game.

Because it’s the most important language of all, and because each individual wants to naturally select that which performs each function of money best, the hardest, soundest, most powerful money comes out on top.

Today, the USD reigns supreme not through merit, but because it is enforced by a kabal. Bitcoin will be the global standard, not because of some fiat decree or the force of the nation state, but through natural, market selection.

That’s what makes it so powerful.

THE PHILOSOPHICAL RATIONALE

The economic case for bitcoin stems from the philosophy of Bitcoin and the principles it embodies.Bitcoin is about a move away from “rulers” and toward “rules.”

It does this because of a series of market-selected attributes it has, and because it has emerged organically in a path-dependent order. The three core innovations of Bitcoin are:

- Digital scarcity

- Autonomous consensus

- Digital immutability

These are the result of the zero-to-one moment that occurred on January 3, 2009, with the Bitcoin genesis block.

The immaculate conception has occurred and the path that Bitcoin has followed since can no longer be repeated. It was a once-in-history genesis and series of path-dependent events.

We now have a perfect money and a perfect monetary network that anyone, anywhere can use and/or build on.

This is the future, and what follows are elements of the Bitcoin philosophy which make it unique.

DECENTRALIZATION

The word “decentralized” gets thrown around a lot, but it doesn’t mean much outside of the context of actual control or cheap verifiability at the level of the individual.

In 2017, we had the block-size wars with a faction of Bitcoiners who believed that transactional throughput on the base layer was more important than ensuring the network was as cheaply verifiable as possible.

Multiple forks of Bitcoin split from the main chain, and there was even an attempt by miners and large-scale exchanges to coerce the network into doubling the block size as part of some “reasonable middle ground.”

It too failed, showing not only the resilience of the network to attack (whether internal or external), but the decentralized nature inherent in Bitcoin. The citizens of the network, the node operators, rejected the corporate and overlord versions of bitcoin, and the HODLers put their money where their mouths were and backed Bitcoin, not some knock-off version.

Today, it is cheaper than ever to run your own node, and as such, Bitcoin’s network topography is ever more decentralized. In fact, it’s the only network on which you can be a first-class citizen that enforces the Bitcoin consensus rules for less than $100!

Ethereum, for example, is so bloated that YOU CANNOT download the blockchain and run a node. In fact, it’s about to get a whole lot worse because once it moves to proof of stake, the 32 ETH required to be a validator will price 99.9% of people out. In other words, Ethereum will be run by those with all of the ETH. Sounds just like modern central banking to me.

The BCashers,BSVers are in the same boat. They chose to scale their base layer linearly, by increasing the block size. Empty blocks aside (i.e., nobody is using these things), this has resulted in a bloated blockchain with a single group of validators (only miners). There are no node operators on these networks and the larger their blockchain grows, and the more junk they throw on it, the more it will require data-center-level operators to not just mine but actually store their blockchains, leading toward complete centralization.

They’re there already. BSV is basically run by one company: CoinGeek. Bcash is run by Roger Ver. So much for decentralization.

The trade-offs made by Bitcoiners and the Bitcoin network have been naturally selected to ensure maximum decentralization and, as such, maximum aversion to change of any kind. Therein lies its strength as a standard.

Nic Carter wrote a brilliant piece on Bitcoin’s trade-offs here: “Bitcoin Bites The Bullet.”

LAYERS

Nature scales in layers. Engineering scales in layers. All human cooperation scales in layers. Communication networks, energy transmission media and all other networks we’re aware of scale in layers.

The Bitcoin network’s layered approach is in line with what works.

It’s not only impossible to make a single layer do everything, but it’s an absolutely ridiculous pursuit.

Everything you add begins to impact another element. What some people fail to realize (much like central planners and bureaucrats) is that every action has a reaction and every decision has a cost or a consequence.

In the prior example, I noted that by trying to cram more transactions and data onto the base layer, you make it more expensive for people to run a node, thereby impacting the network’s decentralization.

The same goes for attempting to make the base layer private. The cost of doing this is the sacrifice of verifiability and auditability of the base chain. That’s not a price we need to pay, especially when we can abstract privacy to a higher layer.

One of Bitcoin’s greatest strengths is its native scripting language, which enables the codification of simple contracts. This allows the abstraction of things like transaction throughput, multiparty authorization and privacy without having an impact on the security, decentralization and immutability of the base layer.

In fact, it allows Bitcoin to scale across multiple dimensions exponentially. With Lightning, for example, anyone can be a node for transactions, which means throughput can scale geometrically.

This is so incredibly important, but seems to be lost on linear thinkers.

Finally, the layered nature of Bitcoin means that not only do the network effects get stronger and compound on themselves, but the network becomes more and more decentralized. We introduce new layers to the network, each with their own skin in the game, making it ever more difficult for any participant, group or layer to have influence over another.

It’s engineering perfection.

CENSORSHIP RESISTANCE

When people talk about decentralization, they fail to realize that this is actually a means to a more important end.

That end is the network’s resistance to change or censorship.

This is categorically the most important attribute for a global digital money. Something whose supply cannot be altered, whose medium of exchange function cannot be censored and whose rules cannot be directed by anyone.

And how does Bitcoin achieve this?

COST.

Bitcoin transforms raw energy, via computational work (something that cannot be forged or faked) into monetary energy, giving us a thermodynamic guarantee of truth. This is further enhanced by the spread of full node operators, Bitcoin HODLers, second layer operators and infrastructure players all around the world.