Bitcoin will be part of history and the futur

Bitcoin will be part of history and the futur

-

January 5, 2020

- Posted by: Farhad

Bitcoin represents the explicit encoding of previously implicit values of the tech community. It’s not just software — it is a Schelling point and a symbol. As such, it will become widely recognized as the flag of technology over the course of the 2020s.

To understand this claim, we need to define what “technology” is, what a “flag” would mean in this context, and why Bitcoin would be chosen as that flag. Let’s proceed in turn.

Technology: the values behind the valuations

Technology is the culture that Silicon Valley built and exported. It is the global community of founders, investors, engineers, and designers. And it is the code, apps, products, and billion dollar companies. But most fundamentally, it’s the values that underpin the valuations.

But they usually aren’t articulated outright. If we were to enumerate them, we’d find that technology is internationalist, capitalist, decentralized, hyperdeflationary, networked, encrypted, digital, volatile, ambitious, and quietly revolutionary. These are the values of technology.

Bitcoin (and crypto more generally) moves us beyond the implicit by expressing these values in a piece of code that doubles as an investment vehicle. The code speaks to the developers, the upside appeals to the investors, and the values encoded within speak to both. If you believe in these values, you tend to buy Bitcoin.

Bitcoin: an ideological flag and a Schelling point

Recall that not every flag represents a geographical entity. Some of them represent movements, like the Gadsen flag or the rainbow flag. Bitcoin becomes a flag in this sense, as the encoding of technology’s aforementioned values. An ideological flag, rather than a geographic one.

Bitcoin also becomes a flag in another sense: a rallying point, a Schelling point for an entrepreneurial community.

Recall that a Schelling point occurs when a community coordinates without explicit coordination. The classic example is when two strangers know that they must meet in New York City on a given day, but are not told where or when. They need to guess what the other person will do without communicating with them. The equilibrium solution to this is usually “meet at 12 noon in front of the Grand Central Terminal information booth.”

Similarly, if we asked the question of what two random people in the global tech community would coordinate on, we start to find that American, Chinese, and Russian technologists who otherwise don’t agree on much tend to agree that Bitcoin is valuable.

For example, Jack Dorsey runs Twitter, Reid Hoffman founded LinkedIn, and Marc Andreessen and Peter Thiel are on the board of Facebook – but all of them are pro-Bitcoin. Similarly, Binance founder Changpeng Zhao and Telegram founder Pavel Durov are Chinese-Canadian and Russian expatriates respectively, and are also pro-Bitcoin. Different countries, different backgrounds, but a shared belief in digital currency.

It’s hard to get folks like this to all agree on something. If you think about it, the global tech community is not going to line up behind Google, or Facebook, or WeChat, or Yandex. Even if a founder respects the products these companies built, as a capitalist they are always aware that there may be economic disalignment at some point in the future. What is good for Google may not always be good for you.

What technologists do tend to align around are (a) open source projects where alignment is less material and (b) investments where alignment is quantifiable. Bitcoin is both of these.

With respect to open source, the closest analogy to Bitcoin may be Linux. Like Linux, all can profit from Bitcoin but none can corrupt it. For example, Google and Facebook are tough competitors – but they cooperate on Linux because it’s a demilitarized zone where one party cannot deprive the other of their contributions. Microsoft may have its own OS, but even Microsoft has to respect Linux nowadays.

Similarly, within the crypto community as well – which is overlapping with but not identical to the tech community – whatever project someone is starting, they are aware of Bitcoin, respect it, and likely hold some. Whatever exchange someone is running, they will have Bitcoin support. Whatever crypto tutorial someone is writing, they will assume the user knows something about Bitcoin.

Bitcoin is thus many people’s first choice and many people’s second choice. This means it will become the community’s first choice. That’s why Bitcoin is also a flag in the sense of a Schelling Point – something to rally around.

Bitcoin encodes the values of Technology

But when the global tech community rallies around the flag of Bitcoin, what exactly is it getting behind?

As noted above, we argue that Bitcoin encodes the following implicit values of technology: internationalist, capitalist, decentralized, hyperdeflationary, networked, encrypted, digital, volatile, ambitious, and quietly revolutionary. Let’s go through each of these in turn.

Internationalist

Bitcoin and technology are both intrinsically internationalist.

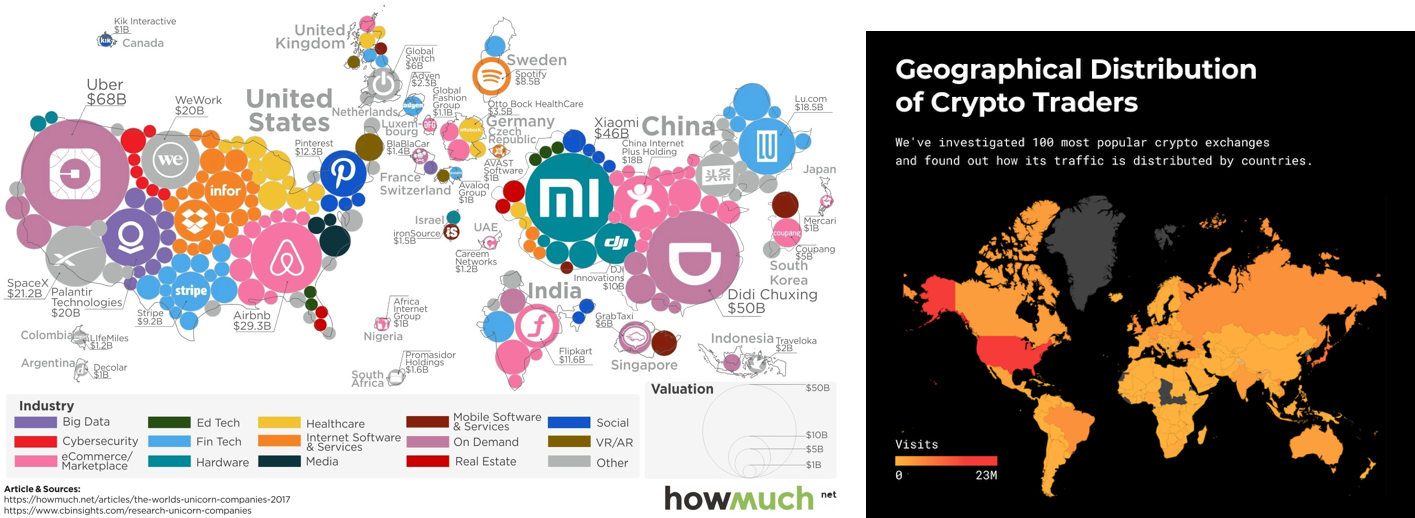

The tech industry may have begun in Silicon Valley, but it’s a global phenomenon at this point. Within the US, more than 60% of the most valuable technology companies were founded by first and second generation immigrants. And with 51% of unicorns now outside the US, tech extends far beyond Silicon Valley to every country with an internet connection.

The same is true for Bitcoin. Millions of crypto traders are distributed across the world, there are thousands of Bitcoin meetups happening in hundreds of cities, and every major nation state is aware of cryptocurrency.

Capitalist

Bitcoin and technology are both fundamentally capitalist.

The tech industry proper revolves around entrepreneurs, angel investors, venture capitalists, M&As, and IPOs. The broader tech community also includes academic engineers and the open source community, neither of which are for-profit, but both of which are far more capitalism-friendly than their counterparts in academic humanities departments and traditional nonprofits.

Bitcoin likewise is about capitalism. It is a ledger of transactions. It is a speculative investment. It is the digitization of money. It is a transnational form of property rights. It’s delivered venture returns. And it encodes the history of an entire economy in its blockchain. As such it’s intrinsically capitalist.

Decentralized

Bitcoin and technology are both highly decentralized.

As Benedict Evans noted recently, the great thing about tech monopolies is how many there are to choose from! Any market map of a tech sector will show the same thing: a profusion of dozens or hundreds of companies in any industry, all vying for different pieces of the market. There are hundreds of millions of websites, almost five million startups on AngelList, thousands of angel investors, and hundreds of large VC firms. There is no single chokepoint in tech, no one financier or platform that you must deploy on to succeed.

The same is true for Bitcoin, and crypto more generally. Satoshi famously designed Bitcoin such that no single miner could censor transactions on the network, and called it “completely decentralized with no server or central authority”. While there’s always more to be done in terms of quantifying and improving decentralization, the ecosystem has miners, nodes, exchanges, developers, and investors, each of whom have competing interests, and (ideally) none of whom has a veto over Bitcoin.

Finally, there’s one more level of decentralization: decentralization across coins. There are now enough different approaches to consensus and privacy that it’s highly unlikely that cryptocurrency as a phenomenon will ever vanish. The vulnerabilities for proof-of-work are not the same as those for proof-of-stake, delegated proof-of-stake, proof-of-space, and so on. It’s unlikely that any single issue can now take out all coins and all exchanges simultaneously. At least some will survive.

Thus in an absolute worst case scenario of a global crackdown on cryptocurrencies where Bitcoin itself is found to suffer from an unfixable vulnerability, we can expect a partial migration to surviving coins as well as an import of the Bitcoin ledger into one of the surviving chains. The reason is that Bitcoin ledger is so highly replicated, and has so many stakeholders behind it, that it is practically impossible to erase from the earth. It will be snapshotted and restored over and over again – even if the original network is shut down.

Hyperdeflationary

Bitcoin and technology are both agents of hyperdeflation.

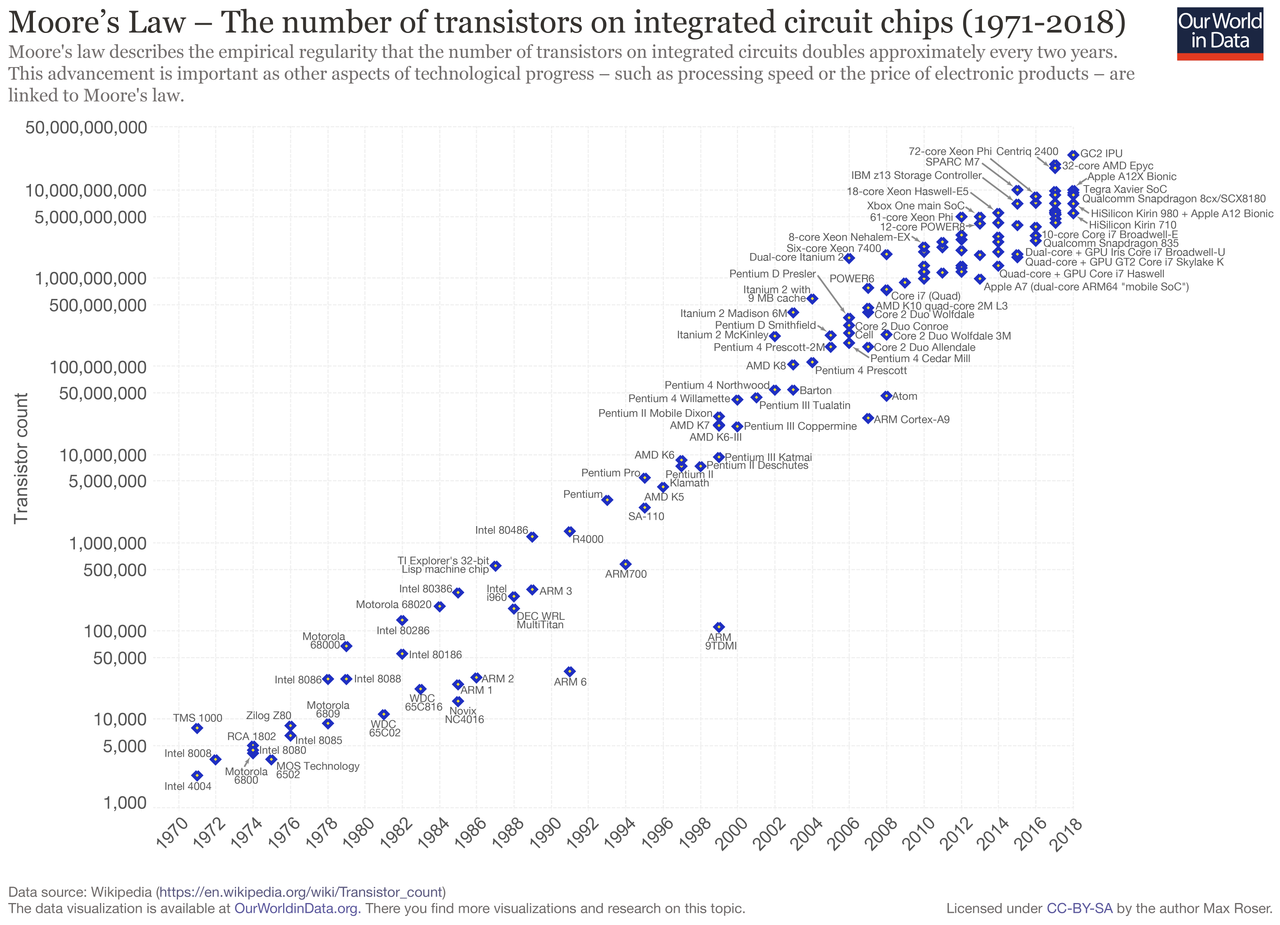

The single most important graph in technology is arguably Moore’s law. That’s a story of hyperdeflation: if the number of transistors on an integrated circuit doubles every two years, the cost of computing roughly halves over the same period. In other words, the same dollar will buy more compute power tomorrow than today, even taking inflation into account.

And it’s not just compute power. The areas that technology has disrupted have seen plummeting prices. We can see this visually, if we compare the number of different pieces of hardware replaced by a single iPhone. We can see this quantitatively, if we compare the cost of browsing Wikipedia or Spotify to the equivalent in physical encyclopedias or compact disks. And we can see this visually if we compare the long-term trajectory of costs in the sectors technology has touched (televisions, software, phones) to those it has not yet disrupted (education, healthcare).

Bitcoin is also hyperdeflation incarnate. It’s not just that BTC was the best investment of the 2010s, and increased by orders of magnitude in value relative to the USD over the last ten years – though it’s always worth keeping this miraculous ten year chart in mind.

It’s also that Bitcoin represents a form of hyperdeflation complementary to and different from Moore’s law. If Moore’s law was about creating value by reducing the cost of computation, Bitcoin is about capturing value by shielding it from inflationary pressure. Or as the meme goes:

Eventually, if Bitcoin truly achieves its destiny, we’ll use BTC as a unit of account. That’s called hyperbitcoinization.

Networked

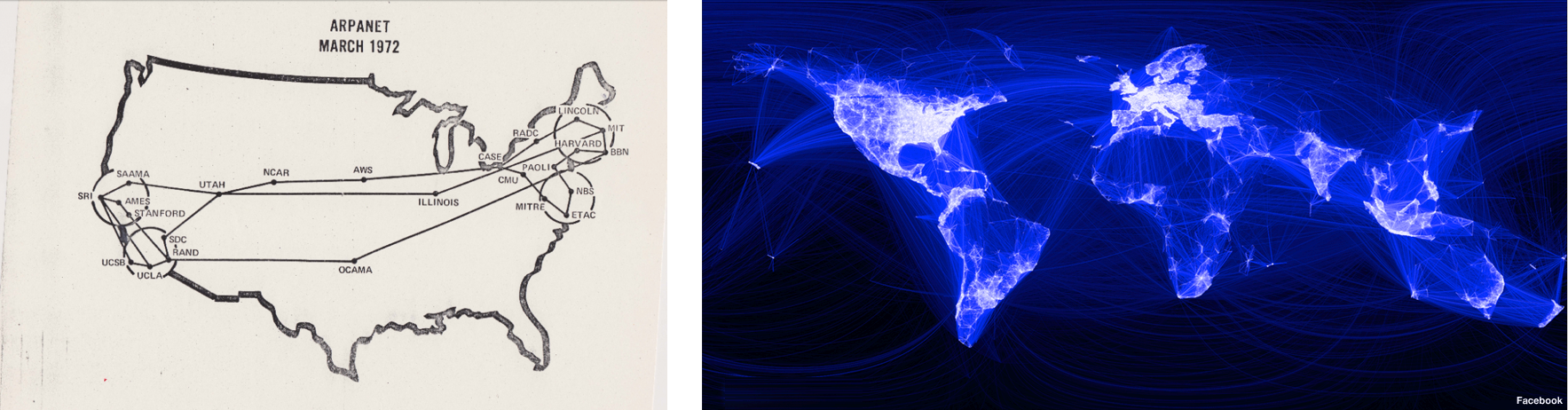

Bitcoin and technology are both network-based.

To say that technology is based on the internet is obvious. To say that it is about social networks, loose collaborations, non-geographical associations, and routing algorithms is also obvious. But the long-term implication of this is that the geodesic distance between two points in a social network is becoming more important than the great circle distance between two points on the surface of the earth.

So too with Bitcoin, and cryptocurrency more generally. Perhaps only one in 100 people on the face of the Earth holds Bitcoin today, at most 50 million people. In the early days of Bitcoin it was far fewer.

But they were effectively all together in the same room thanks to the internet. It didn’t matter how far apart they were geographically; they were all part of the same idea, linked through a computer network. They could partially opt out of their country’s currency (based on geographical proximity to their neighbors) and partially opt in to this new world (based on ideological proximity to people of shared mind).

The freedom to associate with anyone, anywhere in the world based on ideas shared through a computer network is a core value implicitly shared by both technology and Bitcoin that is radically different from the premises of the Westphalian state.

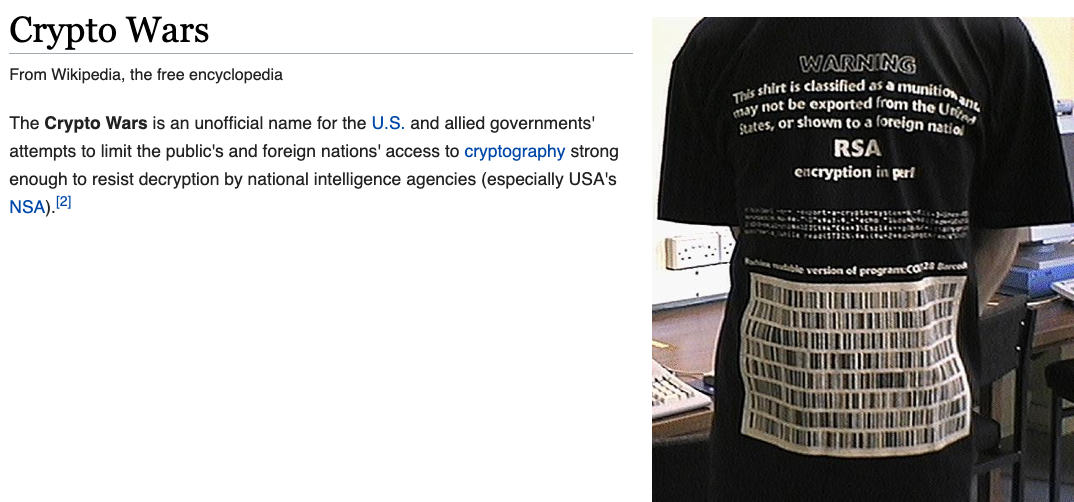

Encrypted

Bitcoin and technology are both founded on encryption.

The modern technology industry only exists because of encryption on the internet. Without SSH for encrypted connections there would be no cloud, no remote work, no deployments. Without SSL and HTTPS for encrypting credit card and wire information there would be no ecommerce, no payment companies, no ads, and no subscriptions. The fundamental engineering and payments infrastructure for creating wealth on the internet would not exist.

Similarly, Bitcoin only exists because of decades of work in theoretical and applied cryptography. Without concepts like public key cryptography, digital signatures, hashing, and hashcash or implementations like SHA-256, RIPEMD-160, and secp256k1, Bitcoin would not be feasible. The fundamental cryptographic constructions required to represent, transmit, and safeguard wealth through Nakamoto consensus would not be available.

Digital

Bitcoin and technology are both inherently digital.

This again is almost too obvious to point out, but over the last thirty years the technology industry has digitized books, magazines, movies, newspapers, photos, letters, advertisements, music, documents, radio, television, and every form of media. Tech has also digitized things we didn’t even think of as “digital” in the 1980s, from your Fitbit steps to your preference settings within an app. And of course digitization unlocked the ability to copy a file, to share it, to edit it, to aggregate it, to do machine learning on it, and much more.

Bitcoin and cryptocurrency more generally are the next phase in digitization. While the technology industry had digitized everything that was not scarce, until Nakamoto consensus we did not have a native representation of digital scarcity. Workarounds like PayPal used a centralized database to simulate digital scarcity, but at base they relied upon a set of permissioned actors with root privileges to guarantee that scarcity. Bitcoin’s blockchain changed all that.

Once people realized that Bitcoin’s blockchain was a cryptographically secure way to represent a public database of who possessed digital currency, they quickly realized that similar approaches could be used to digitize stocks, bonds, commodities, derivatives, REITs, mortgages, loans, and every single kind of financial asset. Moreover, as with the first wave of tech-driven digitization, we will be able to compose these building blocks of digital finance to create new applications. And we are also en route to digitizing identity, property rights, and eventually governance itself.

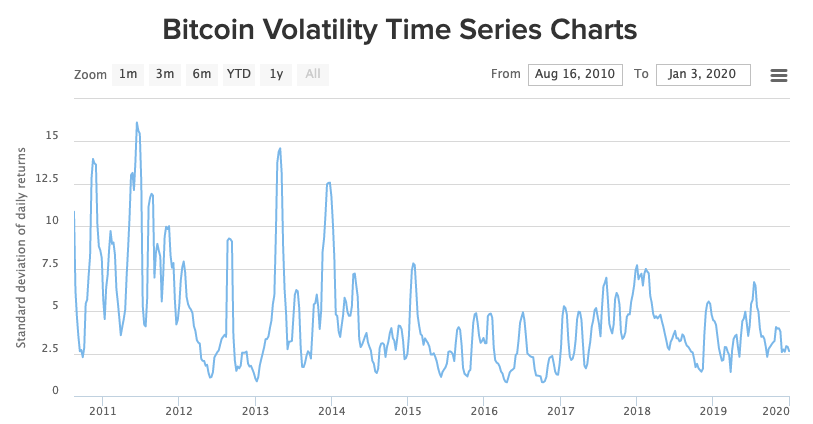

Volatile

Bitcoin and technology are both highly volatile.

You only ever experience two emotions in a startup: euphoria and terror. And I find that lack of sleep enhances them both.

– Marc Andreessen

Startups are volatile. Many startups fail. Bankruptcies are common. Post-mortems are common. Failure is not welcomed, but it is budgeted for, accepted, and possible. VCs are all about the power law, where a single investment can succeed and pay for all the others. Persistent entrepreneurs can sometimes win big. And patient, long-term capital has a chance of winning 1000X returns.

The underlying reason for this is that variance increases with small sample sizes. When you only have ten employees, a single person quitting can tank the company. Conversely, if you only have ten customers and you bring in a large sale, that one event could boost the revenues of the company by 10%, attract a key investment, and lead to the long-term success of the venture.

Bitcoin is similarly volatile. The price graph alone shows multiple 80-90% drops over the past ten years. The number of failed Bitcoin startups is legion. And the number of new Bitcoin millionaires is as well. Bitcoin is, in many ways, the world’s first publicly traded hypergrowth startup. And it is exposing millions of people to the vicissitudes of startup culture, the virtues of persistence and patience, and the downside of quitting too early and proclaiming premature death.

Ambitious

Bitcoin and technology are both breathtakingly but rationally ambitious.

The ambition of the tech entrepreneur is often mocked. But without the belief that one could build a spaceship, create an electric car, organize the world’s information, or connect billions of people, we would simply not have the companies we have today. The strength of technology is realistic ambition, rational ambition, ambition based on calculated risks and quantified upsides.

Bitcoin’s ambition was nothing less than the development of a new digital currency to rival the US dollar. Ten years later, it is clear that every central bank and financial institution in the world has heard of Bitcoin. Today, with the existence of multiple at-scale digital dollars, the very real possibility of China potentially rolling out a blockchain-based digital currency, and Bitcoin’s #40 ranking on the fiat market cap charts, it’s not crazy to say that Bitcoin has changed the world – and may well give the dollar a run for its money.

But it was crazy to think that Bitcoin could compete with the dollar in 2009. It was a piece of software posted on a mailing list! Yet in the very first exchange after Satoshi posted the whitepaper, it was clear that Hal Finney and Satoshi were wildly yet rationally ambitious. Hal calculated a scenario in which each BTC was worth $10M per coin:

As an amusing thought experiment, imagine that Bitcoin is successful and becomes the dominant payment system in use throughout the world. Then the total value of the currency should be equal to the total value of all the wealth in the world. Current estimates of total worldwide household wealth that I have found range from $100 trillion to $300 trillion. With 20 million coins, that gives each coin a value of about $10 million.

So the possibility of generating coins today with a few cents of compute time may be quite a good bet, with a payoff of something like 100 million to 1! Even if the odds of Bitcoin succeeding to this degree are slim, are they really 100 million to one against? Something to think about…

Given the ad arguendo supposition that Bitcoin would work at a technical level, he made a Fermi estimate of the valuation based on a set of logical premises. And once Bitcoin’s technology did prove to work, and once enough others understood those premises, BTC got to $10,000 per coin in the first ten years. Of course, that’s not yet $10M and a replacement for the US dollar – but as they say, the first billion is the hardest.

Quietly Revolutionary

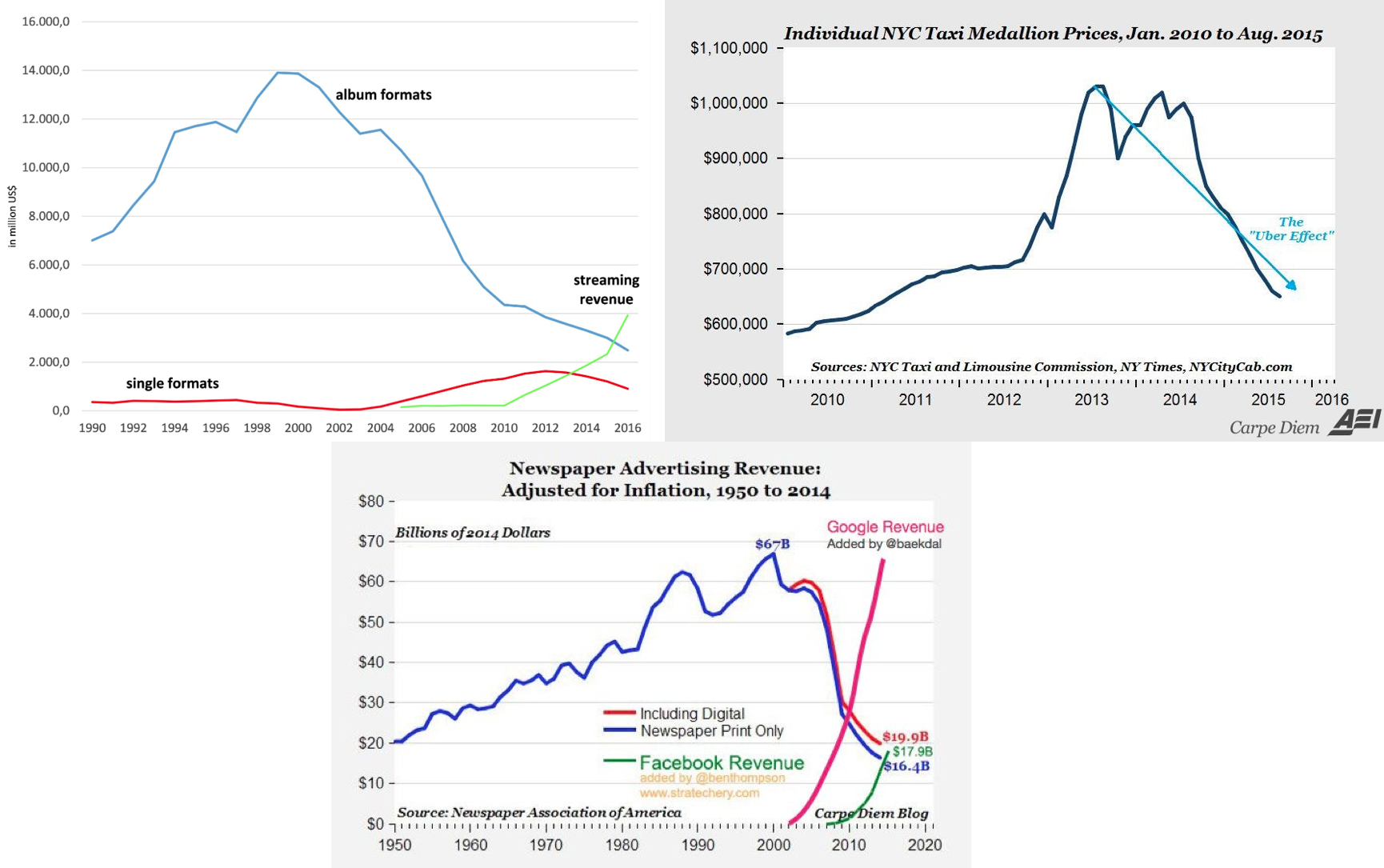

Last, but not least, Bitcoin and technology are both quietly revolutionary.

Technology did not disrupt the music industry, the taxi business, or the newspaper business through traditional political activism. It simply built better products that millions of people voluntarily chose to purchase or use of their own accord. And through these many quiet, individual, personal decisions enormous change was wrought, as these graphs demonstrate:

Similarly, Bitcoin is not about accomplishing change through folk activism. It’s a network-based phenomenon which has accomplished a revolution in monetary policy through a billion private actions rather standing on the street corner spouting slogans. It is quietly revolutionary.

What comes next?

We’ve explained how Bitcoin (and crypto more broadly) encodes the implicit values of technology. It is internationalist, capitalist, decentralized, hyperdeflationary, networked, encrypted, digital, volatile, ambitious, and quietly revolutionary.

I believe that over the 2020s, the technology industry will end up aligning behind Bitcoin and crypto as part of a broader international realignment. Cryptocurrency simultaneously reflects many fundamental American values (like freedom of speech, freedom of contract, freedom of association, protection against unreasonable search & seizure, the right to privacy, and so on) while also demonstrating broad international appeal to millions of people around world.

This realignment would not be traditional right vs left, but rather land vs cloud, state vs network, centralized vs decentralized, new money vs old money, internationalist/capitalist vs nationalist/socialist, MMT vs BTC, and (perhaps most symbolically) Hamilton vs Satoshi. The new American center may be decentralized.